Mr Buffett tends to write allegorically when in defensive mode. The allegorical phrases are in red. Interesting read.

Buffett admits Berkshire battered but stays bullish -- In typical fashion, Mr Buffett told investors that 2008 "was devastating ... for corporate and municipal bonds, real estate and commodities. By year end, investors of all stripes were bloodied and confused, much as if they were small birds that had strayed into a badminton game". Mr Buffett also warned that the greater reliance on government aid was likely to lead to unwelcome and lasting consequences for the wider economy: "In poker terms, the [US] Treasury and the Fed have gone 'all in'. Economic medicine that was previously meted out by the cupful has recently been dispensed by the barrel. These once-unthinkable dosages will almost certainly bring on unwelcome after-effects. Their precise nature is anyone's guess, though one likely consequence is an onslaught of inflation."Gibraltar 定义是 An invincible fortress or stronghold; an impregnable stronghold.

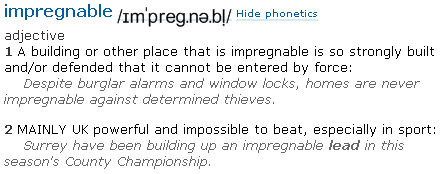

While conceding there was little reason to expect a quick improvement in the global economy, Mr Buffett stressed Berkshire Hathaway would remain "Gibraltar-like" in its financial strength and invited investors to consider that its insurance arm, Berkshire Hathaway's biggest business along with the group utilities investment division, "delivered outstanding results in 2008" and has "excellent prospects".

No comments:

Post a Comment