Ref: http://www.billshrink.com/blog/the-worlds-most-profitable-companies/

Wednesday, December 23, 2009

The World's Most Profitable Companies

at

12/23/2009 02:32:00 PM

0

comments

![]()

Labels: economics

Sunday, December 20, 2009

Tuesday, December 15, 2009

Sunday, November 22, 2009

Don't eat peanut butter unless your mom made it

I've been reading a popular health book, The China Study, published in 2005. In case you have yet heard some of the startling content in it, I'm sending you this piece of info. for your reference.

On page 34 of The China Study, researcher says, 'Considerable evidence had been emerging, first from England later from MIT (the same lab that I had worked in) 10, 11 to show that peanuts often were contaminated with a fungus-produced toxin called aflatoxin (AF). It was an alarming problem because AF was being shown to cause liver cancer in rats. It was said to be the most potent chemical carcinogen ever discovered.'

On page 35, he continues, 'We learned that peanuts and corn were the foods most contaminated. All twenty-nine jars of peanut butter we had purchased in the local groceries, for example, were contaminated, with levels of AF as much as 300 times the amount judged to be acceptable in U.S. food. Whole peanuts were much less contaminated; none exceeded the AF amounts allowed in U.S. commodities. This disparity between peanut butter and whole peanuts originated at the peanut factory. The best peanuts, which filled "cocktail" jars, were hand selected from a moving conveyor belt, leaving the worst, moldiest nuts to be delivered to the end of the belt to make peanut butter.'

Google "peanut butter aflatoxin"

If you don't eat Chicken McNuggets due to its controversy, then you probably don't want to eat jarred peanut butter neither...

at

11/22/2009 10:51:00 AM

0

comments

![]()

Labels: diet, peanut butter

Atkin and The China Study

Although the author of The China Study might not have much good to say about Atkin, which inspired my research and practice of healthy diet, he actually offers some more insights and evidence to my current dietary routines that I'm enjoying with my family.

I'd just skin the arguments and just post the "HOW TO EAT" chart for you to see.

The "Avoid" part of the section is what I'm interested to know more. I'd say I've been practicing mostly everything above the "Avoid" part of the chart.

at

11/22/2009 12:57:00 AM

0

comments

![]()

Labels: diet

Thursday, October 01, 2009

Restaurant Performance Index correlates S&P 500 (Update 1)

Restaurant Performance Index (RPI) – a monthly composite index that tracks the health of and outlook for the U.S. restaurant industry. The RPI is based on the responses to the National Restaurant Association’s Restaurant Industry Tracking Survey, which is fielded monthly among restaurant operators nationwide on a variety of indicators including sales, traffic, labor and capital expenditures.

I can't help myself but draw a correlation between the RPI and S&P 500. The S&P came out of the 2002-2003 triple bottom during the PRI crossover from contraction to expansion. The S&P peaked during the crossover from expansion to contraction in 2007. Is the RPI becoming the new leading indicator of the US stock market?

edited on 10 Dec 2010: the link of the restaurant.org is updated. And I'm going to check out the recent trend and see if we see something more interesting coming out of this. :>

at

10/01/2009 07:15:00 AM

34

comments

![]()

Labels: economics

Qlock

Qlock is awesome. The world's major Forex market hours are horizontally displayed on the top of the screen without hindering other normal mouse movements.

The FREE version is already good enough. Two thumbs up! I like it a lot.

at

10/01/2009 04:59:00 AM

0

comments

![]()

Labels: software

Wednesday, September 30, 2009

Tuesday, September 29, 2009

Monday, September 28, 2009

Test Blog using Google Sidewiki

I cannot access Blogger.com cuz the Chinese government blocks the access to Blogger.com, Twitter.com and Facebook.com, etc. But here it seems to be a great solution available to cure the predicament. It is by using Google Sidewiki.

However, the price that comes with it is to have a "in reference to" and a link to whatever I'm reading on the bottom of each blog entry.

The heck with it since the spark to inspiration often comes when I was reading some webpages anyway. Let the "in reference to" becomes the reference of the spark then.

Monday, May 04, 2009

Saturday, May 02, 2009

Sunday, April 19, 2009

美国新基建项目

奥巴马为了洗钱,搞什么都是大条道理,无人够佢『拗』,中文应该改姓『拗』!之不过,high-speed railway向来都是我非常支持的基建服务。上海、京津的300km/hr试过之后,我已经觉得无任何理由不去大力推广这种舒适快捷的交通方法。我看过一些资料说,high-speed railway 的磁浮科技,如果认真发展,不会慢过现在的民航飞机的!

at

4/19/2009 05:57:00 PM

1 comments

![]()

Labels: news

Saturday, April 18, 2009

Walmart field trip 和 Matrix

看Walmart的企业成长故事看了不少,听说深圳有Walmart,我今日带一家大小去了一次field trip!

据我老婆『最抵精明眼』分析报告指出,深圳华侨城的Walmart是比我们现在居住的南山缤纷超市贵!

去Walmart那一程的出租车司机搭讪,他发现我们是深圳盲,说超市有啥好逛的,介绍我们去益田假日广场逛。我费事『口水多过茶』向他解释field trip的本意,只知道那个什么益田假日是名店mall,我就说那个商场的东西看了买不起,无啥意思。

我非常后悔作出如上回应。

坐在后座位抱住两个女的老婆听到了。

现在,几时去假日广场逛成为了她下一个休闲目标!

幸好两个女是BB,我已经可以想象,以后就三巴嘴游说我去逛名店啦!

为了纠正这些对物质无谓虚幻的憧憬,我晚上赶紧接上个烂鬼DVD player(一直太忙,上周末又加班),插入 Matrix 第一集当 TV dinner 重播,希望潜移默化能影响一下她们啦。

原来 Walmart 已经在中国开了145间啦。时间过得真快,距离我第一次在读书时候听Walmart入中国,好似才不久之前!

at

4/18/2009 06:19:00 PM

0

comments

![]()

Labels: daily

Sunday, April 12, 2009

孩子天生是不会说谎的

某儿童教育家说孩子天生是不会说谎的。

错!

我的一岁半女儿前天的撒谎行为则为明证。

August不喜欢『坐』婴儿车,她更喜欢『推』婴儿车。我老婆带她出外,为了安全和快捷,一般都不让她自己推自己的婴儿车,宁可她坐在里面。

August为了下车,用尿尿作为借口。下车后,还蹲下装模作样。一滴都出不来,无尿。

她站起来后,急步推车走了。

老婆报称August刚刚几分钟前才把尿,马上又要尿尿,摆明撒谎,借尿下车!

at

4/12/2009 03:42:00 PM

3

comments

![]()

Labels: daily

Saturday, April 11, 2009

深圳 pk 广州

在深圳过了几天,发觉和广州最大对比之一,就是深圳无蚊,不用挂蚊帐。另外一个最大的对比,就是生活非常『斋』。我问了一下朋友,除了和朋友腐败之外,深圳还可以有什么工余活动,基本上每个人都只会本能地说欢乐谷。

每次我对朋友谈起欢乐谷的机动游戏,我都很激动!那鬼地方我很久之前去过一次。结论就是欢乐谷很欢乐,我却很郁闷;入场费收得这么贵,每个机动游戏,我还要顶着个大太阳底下排队排老半天,实在太过分了。

广州有很多公园,有白云山,有历史名胜。深圳虽然也有几个公园,但是去过一个最近的南山公园,却发觉不咋样,对比广州的公园的人文氛围也差远了。

at

4/11/2009 03:19:00 PM

0

comments

![]()

Labels: dairy

Saturday, April 04, 2009

A New Earth、『唐山大兄』和『白髮魔女傳』

晚上在某時鐘賓館逗留了兩小時,洗澡后,看了兩部電影尾段:『唐山大兄』和『白髪魔女傳』。

我只知道周星馳和梁朝偉都很崇拜李小龍,卻重來都未看過李小龍的電影。我今天有幸看到他的作品『唐山大兄』在電視播出,聚精會神欣賞了一會兒。相比現在的武打電影,前戲打斗,李小龍打壞人小嘍羅的場面只能用一個字形容:假,或兩個字:好假!不過,尾段打大佬,動作則較為精彩,對期望值有個交待,不致失望。

『唐山大兄』播放的同時,『白髪魔女傳』也在另外一個臺播出。

我雖然看過很多影評贊揚林青霞在『白』中的演出,但是,一直都未真正觀看此電影。這次,算是看到了林青霞的頭髪在影片中是為什么 (why) 和如何 (how) 黑變白的了。林青霞飾演的狼女對感情投入太大,期望值過高,稍微失望,盛悲變盛怒,狂性大發。好像吃了 fing 頭丸的狼女,慢鏡頭中,頭髮隨著頭左右使勁擰而飄搖,變成了白色。

at

4/04/2009 11:59:00 PM

1 comments

![]()

Labels: movie

Saturday, March 28, 2009

MetaTrader (MT4) 自动系统交易

MetaTrader (MT4) 有可能是历史最悠久和发展得最全面的的外汇看图及系统交易软件平台。MT4 现今的经营模式是伙拍中小型的外汇经纪行去推广自己的平台,网上一般昵称用 MT4 的经纪行做 MetaTrader brokers. 换句话说,这些经纪行很多时候都是缺乏实力开发一套自己的交易下单软件,而租用 MetaTrader 去给客户做下单用。MetaTrader 的 MQL4 语言是非常受欢迎的交易系统语言。而该语言的语法特征是像 C\Java 。很多人声称该语言让有编程背景的人会容易上路;但是,相对没有编程经验的人来说,很多人都宁可转向去学 EasyLanguage ( Tradestation.com 的编程语言 ) 去了。

一般系统交易开发者学习系统交易历程

- 开始入门可能是用 TradeStation.com 的 EasyLanguage,感觉容易上手但是最后发觉缺乏可控性,更比较容易发现无法 debug 的 bug;

- 系统交易者希望更深化控制交易逻辑,发现 EasyLanguage 缺乏弹性的时候,会发现 MetaTrader 的 MQL4 更得心应手;

- 对于不懂得编程的人,他们会改为应用费用比较高昂的 NeoTicker;

- 最尖端的系统交易方案,大概就是系统交易者直连经纪行接口,用 Java/C/C++ 写的、富有弹性的语言来控制交易逻辑和下单。

这里下载 MetaTrader 4 软件 (是伙拍一家叫做 Alpari 的英国经纪行的) 帐号是可以下载后在软件平台上面免费申请获得的,该软件有中英文界面选择。( 701785 / myj5olh )

这里下载颇为久远的历史数据

http://www.alpari-idc.com/en/dc/databank.html

关于 MQL4 语言的简单介绍

http://www.metaquotes.net/experts/mql4/

MQL4 入门书

http://book.mql4.com/

MQL4 文档

http://docs.mql4.com/

MQL4 程序代码范例分享

http://codebase.mql4.com/

MQL4 开发论坛

http://codebase.mql4.com/

过去几年 MQL4 都有举行比赛,得奖了的,都是这个社区混了一段时间的人,或者赢得奖后,就把代码封存,不开源,或者离开这个社区了。挖到金就走人。呵呵。这里免费出来看的代码,纯属编程范例的观赏,不可能有赚钱价值的。

这一篇是论述自动交易软件的自欺欺人的行径, 以后做系统开发之前, 应该先阅读.

http://articles.mql4.com/cn/570 (

这里有一个 MetaTrader 翻译成中文的文章列表 )

MT4编程及自动交易系统完全手册 - 中文版 ( 论坛登入: usalchemist 密码: freetone12 )

另外一份教程下载

把 ex4 转成 MQL4 的交易逻辑反向工程

http://www.scriptlance.com/projects/1217266321.shtml

有一位计算机研究生招揽交易逻辑

http://forum.mql4.com/12736

Thursday, March 19, 2009

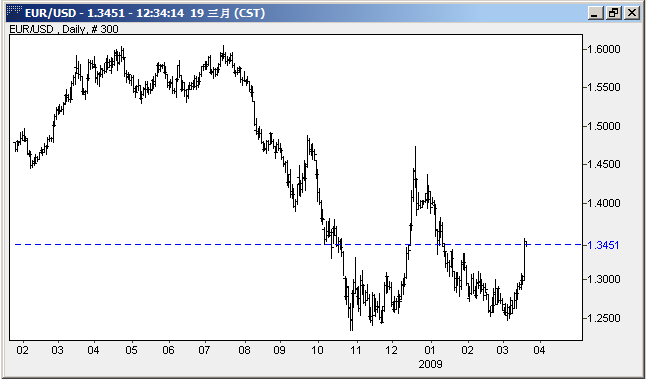

FOMC 最不可能發出的消息 —— 印更多鈔票

所謂劏得豬多就有神庇佑,歐羅有望見底!靚女 Forex 評論員 Kathy 之前貼 FOMC 最不可能發生的那個結果發生了—— Feb 會買入更多債劵。

Least Likely Outcome: Fed Decides to Start Buying U.S. Treasuries – Dollar NegativeEURUSD 狂飆!我是否應該現在脫手手頭的 EURO ,所謂趁好就收?Investors are anxiously waiting for the Fed to announce that they will start buying U.S. Treasuries, but we do not expect it to happen this time around. They have flirted with the idea but are not ready to commitment quite yet because they want to save their last bullets for another rainy day in case the slowdown in the U.S. economy exacerbates. If they do announce a concrete plan to buy longer term Treasuries, yields would fall, stocks would probably rise and the U.S. dollar would be driven lower.

The bottom line is that the Federal Reserve is in this for the long haul and having cut interest rates aggressively over the past few months, they need to slow down and back off to see how the economy responds to all of their stimulus programs. If and only if the credit markets remain frozen and the U.S. economy refuses to improve, should they pull out their final bullets.

at

3/19/2009 12:35:00 PM

0

comments

![]()

Labels: forex

Wednesday, March 18, 2009

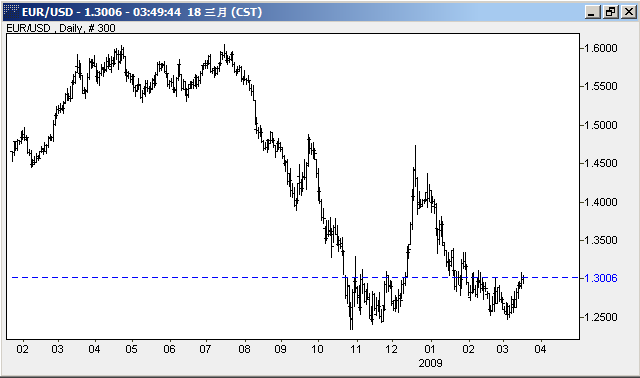

Buy EURUSD

上個月轉曬手頭滴美金做歐羅搏歐羅見底,現在能保持 1.3000 以上,生生性性,維持多幾日,就應該可以有個穩鎮既底部啦,應該系一個穩鎮既雙底添啵!

究竟 EURO 會唔會做好呢?睇尼又系時候劏豬拜神,訴諸宗教信仰既時候啦。

at

3/18/2009 03:50:00 AM

0

comments

![]()

Labels: forex

Monday, March 16, 2009

PREFACE of The 48 Laws of Power

中學時代讀過李宗吾的厚黑學。近年發現原來西方都出了一本暢銷的官場厚黑學48招——The 48 Laws of Power。學 classical studies 的作者 Robert Greene 文筆很好,我經常翻閱他這本著作,當學英文。這里用 ABBYY FineReader 9.0 OCR 了 Preface 出來。

The feeling of having no power over people and events is generally unbearable to us—when we feel helpless we feel miserable. No one wants less power; everyone wants more. In the world today, however, it is dangerous to seem too power hungry, to be overt with your power moves. We have to seem fair and decent. So we need to be subtle—congenial yet cunning, democratic yet devious.

This game of constant duplicity most resembles the power dynamic that existed in the scheming world of the old aristocratic court. Throughout history, a court has always formed itself around the person in power—king, queen, emperor, leader. The courtiers who filled this court were in an especially delicate position: They had to serve their masters, but if they seemed to fawn, if they curried favor too obviously, the other courtiers around them would notice and would act against them. Attempts to win the master's favor, then, had to be subtle. And even skilled courtiers capable of such subtlety still had to protect themselves from their fellow courtiers, who at all moments were scheming to push them aside.

Meanwhile the court was supposed to represent the height of civilization and refinement. Violent or overt power moves were frowned upon; courtiers would work silently and secretly against any among them who used force. This was the courtier's dilemma: While appearing the very paragon of elegance, they had to outwit and thwart their own opponents in the subtlest of ways. The successful courtier learned over time to make all of his moves indirect; if he stabbed an opponent in the back, it was with a velvet glove on his hand and the sweetest of smiles on his face. Instead of using coercion or outright treachery, the perfect courtier got his way through seduction, charm, deception, and subtle strategy, always planning several moves ahead. Life in the court was a never-ending game that required constant vigilance and tactical thinking. It was civilized war.

Today we face a peculiarly similar paradox to that of the courtier: Everything must appear civilized, decent, democratic, and fair. But if we play by those rules too strictly, if we take them too literally, we are crushed by those around us who are not so foolish. As the great Renaissance diplomat and courtier Niccolo Machiavelli wrote, "Any man who tries to be good all the time is bound to come to ruin among the great number who are not good." The court imagined itself the pinnacle of refinement, but underneath its glittering surface a cauldron of dark emotions—greed, envy, lust, hatred—boiled and simmered. Our world today similarly imagines itself the pinnacle of fairness, yet the same ugly emotions still stir within us, as they have forever. The game is the same. Outwardly, you must seem to respect the niceties, but inwardly, unless you are a fool, you learn quickly to be prudent, and to do as Napoleon advised: Place your iron hand inside a velvet glove. If, like the courtier of times gone by, you can master the arts of indirection, learning to seduce, charm, deceive, and subtly outmaneuver your opponents, you will attain the heights of power. You will be able to make people bend to your will without their realizing what you have done. And if they do not realize what you have done, they will neither resent nor resist you.

To some people the notion of consciously playing power games—no matter how indirect—seems evil, asocial, a relic of the past. They believe they can opt out of the game by behaving in ways that have nothing to do with power. You must beware of such people, for while they express such opinions outwardly, they are often among the most adept players at power. They utilize strategies that cleverly disguise the nature of the manipulation involved. These types, for example, will often display their weakness and lack of power as a kind of moral virtue. But true powerlessness, without any motive of self-interest, would not publicize its weakness to gain sympathy or respect. Making a show of one's weakness is actually a very effective strategy, subtle and deceptive, in the game of power (see Law 22, the Surrender Tactic).

Another strategy of the supposed nonplayer is to demand equality in every area of life. Everyone must be treated alike, whatever their status and strength. But if, to avoid the taint of power, you attempt to treat everyone equally and fairly, you will confront the problem that some people do certain things better than others. Treating everyone equally means ignoring their differences, elevating the less skillful and suppressing those who excel. Again, many of those who behave this way are actually deploying another power strategy, redistributing people's rewards in a way that they determine.

Yet another way of avoiding the game would be perfect honesty and straightforwardness, since one of the main techniques of those who seek power is deceit and secrecy. But being perfectly honest will inevitably hurt and insult a great many people, some of whom will choose to injure you in return. No one will see your honest statement as completely objective and free of some personal motivation. And they will be right: In truth, the use of honesty is indeed a power strategy, intended to convince people of one's noble, good-hearted, selfless character. It is a form of persuasion, even a subtle form of coercion.

Finally, those who claim to be nonplayers may affect an air of naivete, to protect them from the accusation that they are after power. Beware again, however, for the appearance of naivete can be an effective means of deceit (see Law 21, Seem Dumber Than Your Mark). And even genuine naivete is not free of the snares of power. Children may be naive in many ways, but they often act from an elemental need to gain control over those around them. Children suffer greatly from feeling powerless in the adult world, and they use any means available to get their way. Genuinely innocent people may still be playing for power, and are often horribly effective at the game, since they are not hindered by reflection. Once again, those who make a show or display of innocence are the least innocent of all.

You can recognize these supposed nonplayers by the way they flaunt their moral qualities, their piety, their exquisite sense of justice. But since all of us hunger for power, and almost all of our actions are aimed at gaining it, the nonplayers are merely throwing dust in our eyes, distracting us from their power plays with their air of moral superiority. If you observe them closely, you will see in fact that they are often the ones most skillful at indirect manipulation, even if some of them practice it unconsciously. And they greatly resent any publicizing of the tactics they use every day.

If the world is like a giant scheming court and we are trapped inside it, there is no use in trying to opt out of the game. That will only render you powerless, and powerlessness will make you miserable. Instead of struggling against the inevitable, instead of arguing and whining and feeling guilty, it is far better to excel at power. In fact, the better you are at dealing with power, the better friend, lover, husband, wife, and person you become. By following the route of the perfect courtier (see Law 24) you learn to make others feel better about themselves, becoming a source of pleasure to them. They will grow dependent on your abilities and desirous of your presence. By mastering the 48 laws in this book, you spare others the pain that comes from bungling with power—by playing with fire without knowing its properties. If the game of power is inescapable, better to be an artist than a denier or a bungler.

Learning the game of power requires a certain way of looking at the world, a shifting of perspective. It takes effort and years of practice, for much of the game may not come naturally. Certain basic skills are required, and once you master these skills you will be able to apply the laws of power more easily.

The most important of these skills, and power's crucial foundation, is the ability to master your emotions. An emotional response to a situation is the single greatest barrier to power, a mistake that will cost you a lot more than any temporary satisfaction you might gain by expressing your feelings. Emotions cloud reason, and if you cannot see the situation clearly, you cannot prepare for and respond to it with any degree of control.

Anger is the most destructive of emotional responses, for it clouds your vision the most. It also has a ripple effect that invariably makes situations less controllable and heightens your enemy's resolve. If you are trying to destroy an enemy who has hurt you, far better to keep him off-guard by feigning friendliness than showing your anger.

Love and affection are also potentially destructive, in that they blind you to the often self-serving interests of those whom you least suspect of playing a power game. You cannot repress anger or love, or avoid feeling them, and you should not try. But you should be careful about how you express them, and most important, they should never influence your plans and strategies in any way.

Related to mastering your emotions is the ability to distance yourself from the present moment and think objectively about the past and future. Like Janus, the double-faced Roman deity and guardian of all gates and doorways, you must be able to look in both directions at once, the better to handle danger from wherever it comes. Such is the face you must create for yourself—one face looking continuously to the future and the other to the past.

For the future, the motto is, "No days unalert." Nothing should catch you by surprise because you are constantly imagining problems before they arise. Instead of spending your time dreaming of your plan's happy ending, you must work on calculating every possible permutation and pitfall that might emerge in it. The further you see, the more steps ahead you plan, the more powerful you become.

The other face of Janus looks constantly to the past—though not to remember past hurts or bear grudges. That would only curb your power. Half of the game is learning how to forget those events in the past that eat away at you and cloud your reason. The real purpose of the backward-glancing eye is to educate yourself constantly—you look at the past to learn from those who came before you. (The many historical examples in this book will greatly help that process.) Then, having looked to the past, you look closer at hand, to your own actions and those of your friends. This is the most vital school you can learn from, because it comes from personal experience.

You begin by examining the mistakes you have made in the past, the ones that have most grievously held you back. You analyze them in terms of the 48 laws of power, and you extract from them a lesson and an oath: "I shall never repeat such a mistake; I shall never fall into such a trap again." If you can evaluate and observe yourself in this way, you can learn to break the patterns of the past—an immensely valuable skill.

Power requires the ability to play with appearances. To this end you must learn to wear many masks and keep a bag full of deceptive tricks. Deception and masquerade should not be seen as ugly or immoral. All human interaction requires deception on many levels, and in some ways what separates humans from animals is our ability to lie and deceive. In Greek myths, in India's Mahabharata cycle, in the Middle Eastern epic of Gilga-mesh, it is the privilege of the gods to use deceptive arts; a great man, Odysseus for instance, was judged by his ability to rival the craftiness of the gods, stealing some of their divine power by matching them in wits and deception. Deception is a developed art of civilization and the most potent weapon in the game of power.

You cannot succeed at deception unless you take a somewhat distanced approach to yourself—unless you can be many different people, wearing the mask that the day and the moment require. With such a flexible approach to all appearances, including your own, you lose a lot of the inward heaviness that holds people down. Make your face as malleable as the actor's, work to conceal your intentions from others, practice luring people into traps. Playing with appearances and mastering arts of deception are among the aesthetic pleasures of life. They are also key components in the acquisition of power.

If deception is the most potent weapon in your arsenal, then patience in all things is your crucial shield. Patience will protect you from making moronic blunders. Like mastering your emotions, patience is a skill—it does not come naturally. But nothing about power is natural; power is more godlike than anything in the natural world. And patience is the supreme virtue of the gods, who have nothing but time. Everything good will happen—the grass will grow again, if you give it time and see several steps into the future. Impatience, on the other hand, only makes you look weak. It is a principal impediment to power.

Power is essentially amoral and one of the most important skills to acquire is the ability to see circumstances rather than good or evil. Power is a game—this cannot be repeated too often—and in games you do not judge your opponents by their intentions but by the effect of their actions. You measure their strategy and their power by what you can see and feel. How often are someone's intentions made the issue only to cloud and deceive! What does it matter if another player, your friend or rival, intended good things and had only your interests at heart, if the effects of his action lead to so much ruin and confusion? It is only natural for people to cover up their actions with all kinds of justifications, always assuming that they have acted out of goodness. You must learn to inwardly laugh each time you hear this and never get caught up in gauging someone's intentions and actions through a set of moral judgments that are really an excuse for the accumulation of power.

It is a game. Your opponent sits opposite you. Both of you behave as gentlemen or ladies, observing the rules of the game and taking nothing personally. You play with a strategy and you observe your opponent's moves with as much calmness as you can muster. In the end, you will appreciate the politeness of those you are playing with more than their good and sweet intentions. Train your eye to follow the results of their moves, the outward circumstances, and do not be distracted by anything else.

Half of your mastery of power comes from what you do not do, what you do not allow yourself to get dragged into. For this skill you must learn to judge all things by what they cost you. As Nietzsche wrote, "The value of a thing sometimes lies not in what one attains with it, but in what one pays for it—what it costs us." Perhaps you will attain your goal, and a worthy goal at that, but at what price? Apply this standard to everything, including whether to collaborate with other people or come to their aid. In the end, life is short, opportunities are few, and you have only so much energy to draw on. And in this sense time is as important a consideration as any other. Never waste valuable time, or mental peace of mind, on the affairs of others—that is too high a price to pay.

Power is a social game. To learn and master it, you must develop the ability to study and understand people. As the great seventeenth-century thinker and courtier Baltasar Gracian wrote: "Many people spend time studying the properties of animals or herbs; how much more important it would be to study those of people, with whom we must live or die!" To be a master player you must also be a master psychologist. You must recognize motivations and see through the cloud of dust with which people surround their actions. An understanding of people's hidden motives is the single greatest piece of knowledge you can have in acquiring power. It opens up endless possibilities of deception, seduction, and manipulation.

People are of infinite complexity and you can spend a lifetime watching them without ever fully understanding them. So it is all the more important, then, to begin your education now. In doing so you must also keep one principle in mind: Never discriminate as to whom you study and whom you trust. Never trust anyone completely and study everyone, including friends and loved ones.

Finally, you must learn always to take the indirect route to power. Disguise your cunning. Like a billiard ball that caroms several times before it hits its target, your moves must be planned and developed in the least obvious way. By training yourself to be indirect, you can thrive in the modern court, appearing the paragon of decency while being the consummate manipulator.

Consider The 48 Laws of Power a kind of handbook on the arts of indirection. The laws are based on the writings of men and women who have studied and mastered the game of power. These writings span a period of more than three thousand years and were created in civilizations as disparate as ancient China and Renaissance Italy; yet they share common threads and themes, together hinting at an essence of power that has yet to be fully articulated. The 48 laws of power are the distillation of this accumulated wisdom, gathered from the writings of the most illustrious strategists (Sun-tzu, Clausewitz), statesmen (Bismarck, Talleyrand), courtiers (Castiglione, Gracian), seducers (Ninon de Lenclos, Casanova), and con artists ("Yellow Kid" Weil) in history.

The laws have a simple premise: Certain actions almost always increase one's power (the observance of the law), while others decrease it and even ruin us (the transgression of the law). These transgressions and observances are illustrated by historical examples. The laws are timeless and definitive.

The 48 Laws of Power can be used in several ways. By reading the book straight through you can learn about power in general. Although several of the laws may seem not to pertain directly to your life, in time you will probably find that all of them have some application, and that in fact they are interrelated. By getting an overview of the entire subject you will best be able to evaluate your own past actions and gain a greater degree of control over your immediate affairs. A thorough reading of the book will inspire thinking and reevaluation long after you finish it.

The book has also been designed for browsing and for examining the law that seems at that particular moment most pertinent to you. Say you are experiencing problems with a superior and cannot understand why your efforts have not lead to more gratitude or a promotion. Several laws specifically address the master-underling relationship, and you are almost certainly transgressing one of them. By browsing the initial paragraphs for the 48 laws in the table of contents, you can identify the pertinent law.

Finally, the book can be browsed through and picked apart for entertainment, for an enjoyable ride through the foibles and great deeds of our predecessors in power. A warning, however, to those who use the book for this purpose: It might be better to turn back. Power is endlessly seductive and deceptive in its own way. It is a labyrinth—your mind becomes consumed with solving its infinite problems, and you soon realize how pleasantly lost you have become. In other words, it becomes most amusing by taking it seriously. Do not be frivolous with such a critical matter. The gods of power frown on the frivolous; they give ultimate satisfaction only to those who study and reflect, and punish those who skim the surfaces looking for a good time.

Courts are, unquestionably, the seats of politeness and good breeding; were they not so, they would be the seats of slaughter and desolation. Those who now smile upon and embrace, would affront and stab, each other, if manners did not interpose....

Lord Chesterfield, 1694-1773

There is nothing very odd about lambs disliking birds of prey, but this is no reason for holding it against large birds of prey that they carry off lambs. And when the lambs whisper among themselves, ''These birds of prey are evil, and does this not give us a right to say that whatever is the opposite of a bird of prey must be good?" there is nothing intrinsically wrong with such an argument—though the birds of prey will look somewhat quizzically and say, "We have nothing against these good lambs; in fact, we love them; nothing tastes belter than a tender lamb."

Friedrich Nietzsche, 1844-1900

The only means to gain one's ends with people are force and cunning. Love also, they say; but that is to wait for sunshine, and life needs every moment.

Johann von Goethe, 1749-1832

The arrow shot by the archer may or may not kill a single person. But stratagems devised by a wise man can kill even babes in the womb.

Kautilya, Indian philosopher, third century b.c.

I thought to myself with what means, with what deceptions, with how many varied arts, with what industry a man sharpens his wits to deceive another, and through these variations the world is made more beautiful.

Francesco Vettori, contemporary and friend of Machiavelli, early sixteenth century

There are no principles; there are only events. There is no good and bad, there are only circumstances. The superior man espouses events and circumstances in order to guide them. If there were principles and fixed laws, nations would not change them as we change our shirts and a man can not be expected to be wiser than an entire nation.

Honore de Balzac, 1799-1850

Any man who tries to be good all the time is bound to come to ruin among the great number who are not good. Hence a prince who wants to keep his authority must learn how not to be good, and use that knowledge, or refrain from using it, as necessity requires.

The Prince, Niccold Machiavelli, 1469-1527

Friday, March 13, 2009

安特卫普(比利时北部港市)鉆石大劫案

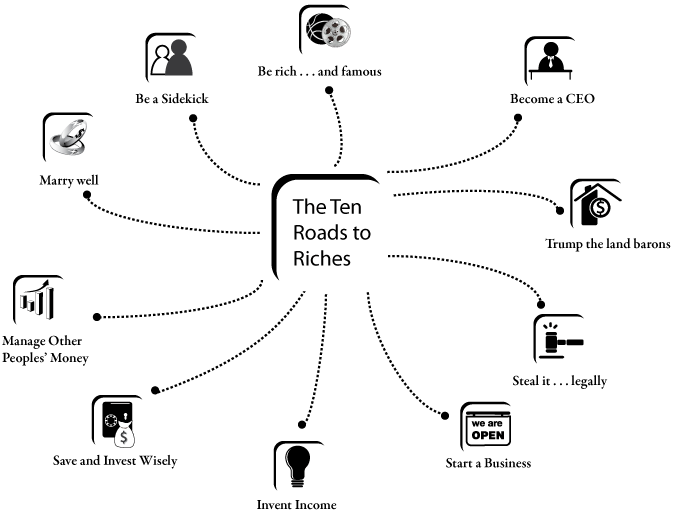

Ken Fisher 的發財吹水書 10 Ways to Riches 說發財有10道。

1. Start a successful business—the richest road! 創業當中第六條,其實可以引申出來第6.5條——Steal it, illegally.

2. Become the CEO of an existing firm and juice it—a very mechanical function. 做CEO

3. Hitch to a successful visionary’s wagon and ride along—it’s high value-added. 找個有『錢』途的工作

4. Turn celebrity into wealth—or wealth into celebrity and then more wealth! 出名

5. Marry well—really, really well. 嫁得好(或娶得好)

6. Steal it, legally—no guns necessary! 合法地偷

7. Capitalize on other people’s money (OPM)—where most of the mega-rich are. 借別人財力

8. Invent an endless future revenue stream—even if you’re not an inventor! 重復性收入

9. Trump the land barons by monetizing unrealized real estate wealth! 地產

10. Go down the Road More Traveled—save hard, invest well—forever! 存錢、投資

很多發達的西方國家,對偷盜判刑都相對東方國家松。偷盜、商業犯罪等罪名,只要無傷害任何人身體,一般判刑都不過10年。一般人10年能賺多少錢?如果不幸失去了自由,自由值多少錢?很多人屈指一算,就能理解(雖然不能原諒)那些吃『大茶飯』、干大案的罪犯。

Wired 雜志的專題報道向來精彩,剛剛發表了一篇劫案專題,訪問了一個發生在2003年2月16日的大案主犯 Leonardo Notarbartolo. 他被判了10年有期徒刑。

以下,讓我們來為他做一個做最壞情況下的風險回報分析。

他們有最多6個合謀者,共盜得了最低限度兩千萬歐羅的鉆石。假如6人瓜分,每人得約等值六千七百萬人民幣價值的鉆石。10年的通貨膨脹能使現金的消費力減產一半,但是因為理論上鉆石能保值,所以,這個六千七百萬人民幣的消費力,倒是可以用現在的眼光來衡量。六千七百萬人民幣除以十年等于平均每年賺得的;換句話說,Notarbartolo 每年失去的人身自由,都能換得六白七十萬元人民幣。歐美講人權,案件不牽涉到國家機密,無所謂逼供招認。Notarbartolo 把鉆石藏在了什么地方,只有他自己才知道,10年后出來,又是一條好漢,有這一筆可觀的鉆石財富讓他去安享晚年。

但是,每年六白七十萬元人民幣的收入,值得冒這么大的險嗎?

失去10年的自由,屬于一種風險嗎?

這些問題,可能對不同的人都會有不同的定義,而我則認為非常不值得。單單是失去的和子女共聚的光陰,就是多少財富都無法補償的風險。

案件發生在 Antwerp (安特卫普).

安特卫普是世界上最重要的钻石交易地点,这里有举世闻名的钻石交易所、1500多家钻石企业 ...... 安德卫普是钻石加工中心,世界第一。世界百分之八十的原钻石被运往这儿进行加工,百分之六十的钻石交易在这儿进行,每年的交易额达到400亿美元。虽然最早发明钻石打磨技术切割技术是在布鲁塞尔,后来随着发明者搬到这儿,安德卫普也就成了名副其实的钻石之都。 -- WikipediaWired 專題記者 Joshua Davis 現身說法寫作背景。

Thursday, March 12, 2009

我有壓力,你有壓力,你做乜唔瞓覺?

公司游戲準備出臺收費版,工作好鬼緊湊。最近我逼人幫手做嘢逼到癲,搞到一個同事。。。(下面看 Skype 聊天對話記錄)

當陣時差滴笑死我!

最近開始都看看佛理入門的書,不期然想起了報應。

今晚我都算有報應了!

剛剛3am發惡夢醒,然后肚餓到死,瞓唔翻,索性就走翻公司上網做下嘢。

at

3/12/2009 06:02:00 AM

0

comments

![]()

Labels: dairy

Wednesday, March 11, 2009

Tuesday, March 10, 2009

年輕男人和老女人生的小孩 IQ 最高

看科學新聞報告研究指出,男人越年輕生育,孩子 IQ 越高,因為優良精子數量多。女人越老生育,孩子 IQ 越高,因為較為懂得教導下一代。

可惜霆鋒和王菲無留個種。

Lucas Cranach the Elder (German, 1472-1553). The Odd Couple: Young Man and Old Woman with Girl, ca. 1545/50.

at

3/10/2009 08:31:00 PM

0

comments

![]()

Labels: science

Monday, March 09, 2009

收市競價交易時段匯豐控股大插水

匯豐又再次插水,而且是插得甘深甘快,相信很多人都跌破了眼鏡。據 Bloomberg 的 Kelvin Wong 文章 HSBC Plunges Record 24% in Hong Kong on Late Trades 介紹,是匯控是在 Closing Auction Session 『收市競價交易時段』的最后一刻落至收市得番33蚊。

『按照香港交易所的一貫做法,若參與者輸入的任何買賣盤大幅偏離當時的成交價,香港交易所將會通知證券及期貨事務監察委員會作進一步調查。價格操控是刑事罪行,法定監管機構必定會提出檢控。』這次插水,不知道是否有人惡意搗亂呢?

無論如何都好,又是時候出動到處瀏覽一下事后諸葛亮們的評論了。

[大手成交]匯豐控股(00005)在下午04:10出現大手賣出,成交量為 1.19千萬,成交價為港幣$33.0,涉資3.927億。至目前為止,股價跌24.138%,今日最高價為$41.55,而最低價為$33.0,總成交量為1.219億股,總成交金額港幣$47.119億。

劉兆祥: 匯控<00005.HK>有七宗罪

2009年3月9日 05:33:50 p.m. HKT, AAFN

信誠證券投資部經理劉兆祥表示,匯控<00005.HK>大跌$10.50,其實匯控股價本身於$37.50之上,但收市競價時段,在最後數秒,突然有4M沽盤推低匯控股價至33元收市,而成交達到12M,究竟這些沽盤目的是甚麼?倫敦匯控最低報310便士,折合港元仍處於34元之上,究竟反映甚麼呢?

其實除了匯控大跌外,本地金融股也有10%跌幅,只是匯控較受矚目。筆者也低估匯控跌勢,以為大戶要在一個較安定的環境來供股,其實分析匯控近期表現,可得出匯控7宗罪:

第一:最初說不用供股,由內部資源可處理問題,結果仍要供股

第二:盈利大跌卻沒有發出盈利警告訊號

第三:以超出投資者預期的大比例供股,12供5股,供股價28元

第四:12供5,使大部份人士的股份手數變為碎股,而12供5後,以400股來說,究竟投資者可供的數目是多少,連中央過戶處與匯控本身也出現分歧,這種不清晰情況使投資者感覺混亂,中央過戶處說是165股,而匯控則說是166股呢?(以12股計,投資者持有一手,得出33.33,究竟小數點的數字應否計入作供股之用,其實匯控本身的計算有錯誤,理論上12供5的話,供股權的尾數一定是5或零,因此未來有頗多的爭吵)

第五:匯控在3月12日除供股權,但在3月18日則除息(每股$0.78),但匯控宣布新供股的投資者沒有股息收入,問題是匯控股價除淨時要將股價調整,假設除息時是33元,除息日股價便是$32.22,使匯控市值變相減少39億元,即供股部份便會帶來損失

第六:匯控預期09年首三季都會派發8美仙股息($0.624港元,三季合供需1.872),但大家都問一個問題,是匯控今年會否見紅,如果確保有這樣高的股息收入呢?

第七:也是匯控股價大跌的原因,就是之前外資大行不斷看淡股價及前景,不排除這些大外之前已經大手沽空,但今次匯控仍然由他們做包銷,使他們可輕易回補空倉盤,更重要是他們有更多的彈藥來大手拋空匯控,慢慢才補回,使股價跌完可以再跌,如果今次匯控能事前與中央溝通,讓中資機構取得一半的包銷數量(到時供股比例可能較目前優勝,例如3供1,每股30元),除了得到中國祝福外,最重要是早前拋空的大戶,知道不可能透過供股來取得股份,便只能在市場買貨,恐怕單是這些補倉盤,已經可以將匯控股價推上60元之上。

可惜匯控管理層一連串的錯誤,使投資者損失慘重,而最重要是反映目前匯控處於當黑期,如果是好運期,這些事一定不會發生,但當行衰運時,便會頭頭踫著黑。

at

3/09/2009 08:15:00 PM

0

comments

![]()

Labels: 0005.hk

Sunday, March 08, 2009

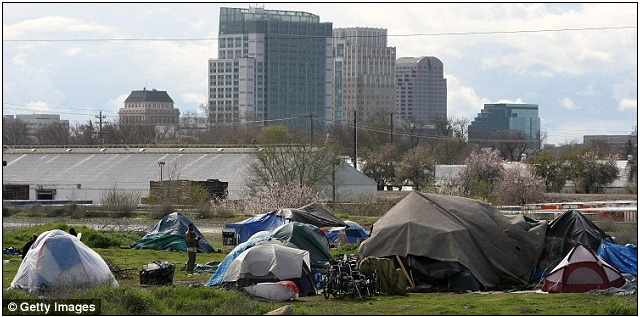

加州省府城外露宿者

美國大蕭條時代大規模出現的露宿景象在 Sacramento 恍惚有苗頭開始重演。怪不得我老豆老母以前笑我去野外行山露營是『作賤』的活動,十足他們當年『上山下鄉』,被迫的行山露營。

Saturday, March 07, 2009

『非農』乃唯一『非典』般傳染力強的經濟數據

黑暗中也會有光明,而那里有光明,那里就能找到真理。

像『黑社會』中,古天樂扮演的 Jimmy 仔,雖然一邊在缽蘭街靠扯皮條搵食,也一邊會去大學修讀經濟,尋找混沌中的真理。

黑暗如聯邦儲備局這種邪惡勢力,有時候仔細看看,都能找到絲絲真理。皆因他們的人也會去講一些對他們既得利益無影響的真理。

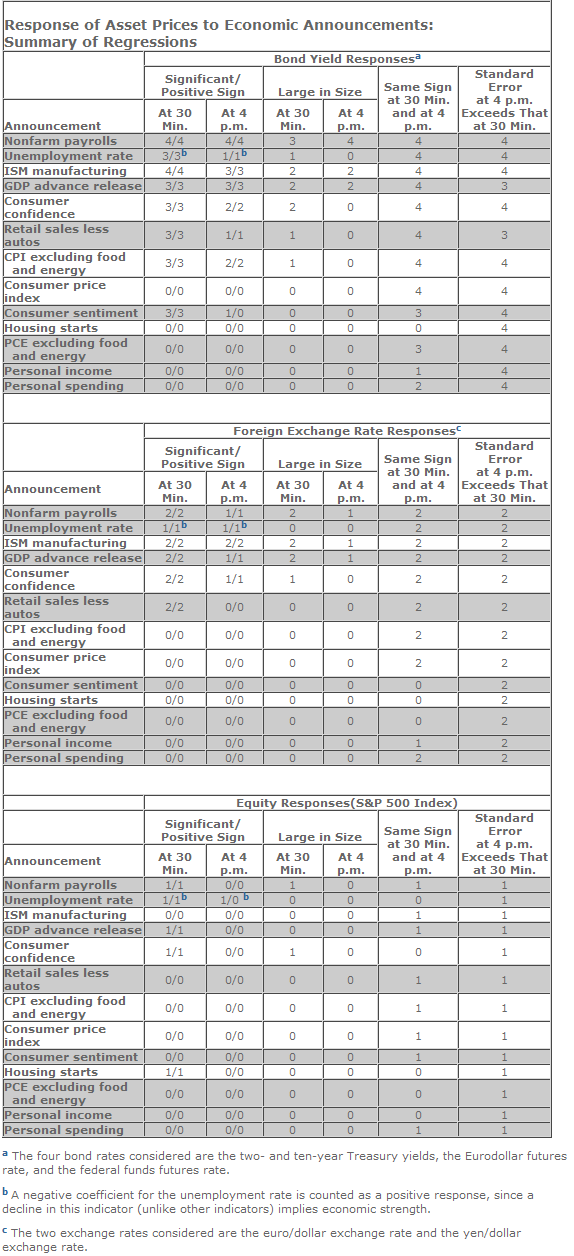

紐約聯儲,2008年出了一篇良心调研: How Economic News Moves Markets ,論述美國經濟數據發布對不同證劵的影響。而剛剛過去這個周五,也再次證實了每月非農 Nonfarm payroll 的數據發布,是巨有能力撥動各個證劵市場的動態,尤其是歐羅對美元匯價 —— NFP 數據在早上 8:30 美國東部時間發布后,歐元對美元隨即 rally 向上飆了一陣。

此報告中最大的真理,就是推翻那些財經新聞中的吹水佬的廢話 —— NFP 數據,無論升降,在歷史數據看來,都對證劵波動的方向性無 correlated 的影響。那些最喜歡事后諸葛亮的電視財經新聞分析師所謂的分析所謂升或跌的因果關系,當笑話聽下就算了,別太認真!

此調研中的一個數據表格,也能說明,其實眾多經濟數據中,也只有NFP對證劵波動幅度具有 consistent 的殺傷力,其他的,則往往會失準。

at

3/07/2009 12:20:00 PM

0

comments

![]()

Labels: economics

Wednesday, March 04, 2009

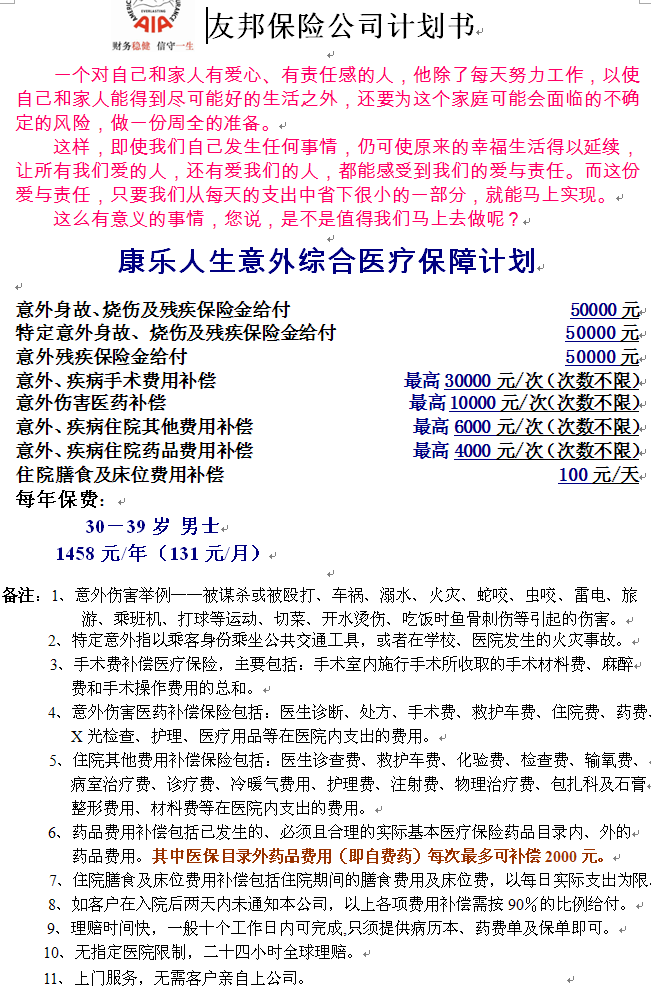

保人者难自保 —— AIA 意外医疗保险

刚刚想搵 AIA 买份保险。今天又爆新闻 AIG 搵 AIA 过桥,让 AIA 给美国政府。AIA 身为 AIG 母公司的赚钱奶牛,原本以为无死,点知现在搞到甘样呢。我份保险单仲应唔应该搵 AIA 买呢?

To further ease A.I.G.'s debt burden, instead of paying back $38 billion in cash with interest that it has used from a federal credit line, government will convert that into equity in two of the insurer’s subsidiaries in Asia — American International Assurance and the American Life Insurance Company.

Both units are performing well. This would give the government direct ownership in those subsidiaries and provide saleable assets to American taxpayers even if the A.I.G. holding company were to default on its loans.

The government stake in American International Assurance will probably be controversial. The unit had been put up for sale recently, without success. That suggests that the government is giving A.I.G. better terms than private investors were willing to give, exposing the government to further accusations that it is providing a handout to A.I.G.

Tuesday, March 03, 2009

S&P 500 hit 700. $INDU:$GOLD closed at 7.19

Would the 700 marks the short-term turning point of S&P? The decline has been too much in too short a time. Should a correction should be in place this week?

Dow and gold has been declining since the beginning of 2009 with no significant correction. When's it due?

at

3/03/2009 08:57:00 PM

0

comments

![]()

Labels: $INDU:$GOLD, charts, SPX

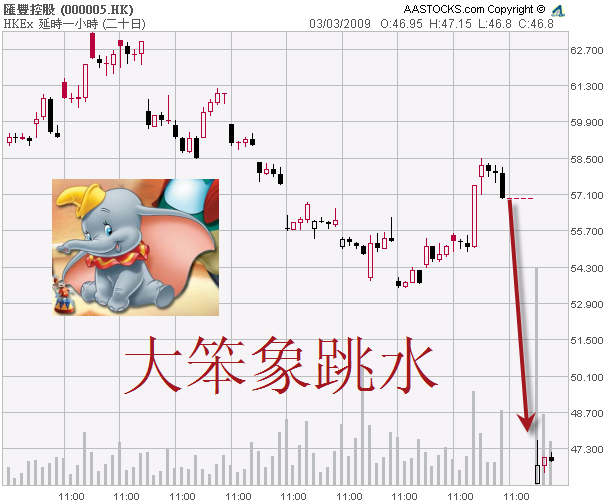

大笨象跳水

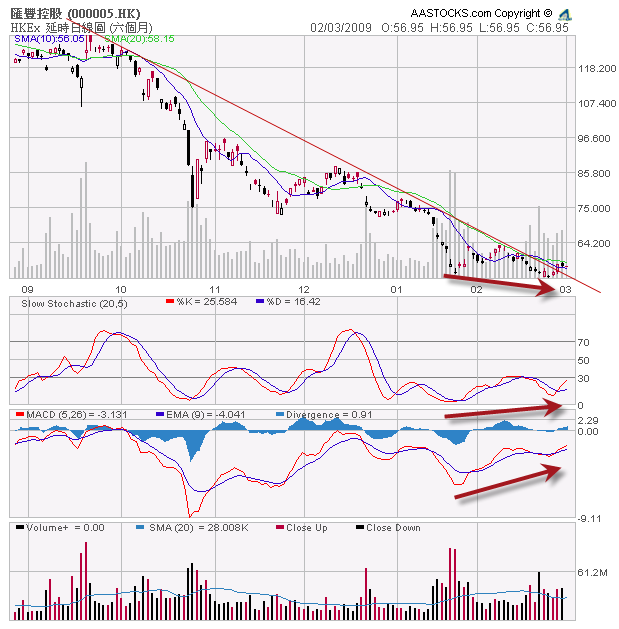

昨天剛剛看到匯控底背離和突破了下降趨勢線,所謂純技術分析,無非就是將基本面暫時剝離。今天,供股消息落實,馬上插水。再回頭看看,原來也有不少新聞預兆了。

昨日 Aastocks 上面的新聞 —— 信誠證券投資部經理劉兆祥表示,今天匯控<00005.HK>停牌,而期指大幅低水達三百點,究竟反映甚麼呢?其實期指大幅低水,只是反映匯控明天復牌後股價大幅回落,以目前倫敦匯控折合港元計48元,即匯控明天大跌超過7元,因此期指便要反映匯控大跌的因素。

至於期指反映匯控除權,提出這個說法的人士,根本不知道恆指的計算方法,如果匯控派息便不會調整,但送紅股或除權的話,指數便會作出調整。

因為期指大炒低水,引致一眾衍生工具發行商在開價時出現技術上問題,究竟應根據期指還是根據恆指呢?如果在正常情況,當然是以期指為開價的基準(因為明天恆指會反映匯控大跌的實際情況),但一些接近死亡的牛證,發行商如何開價便不一樣,例如61805,回收價是12500點,當恆指跌至12550點,期指處於12250點,因此發行商開價時便以$0.06開出,但如果以恆指計,應該值$0.08,因此能夠把握這些錯價機會,便有不俗的利潤。

至於今次匯控供股,較早前流傳的4供1,每股33元更低(如果是集資1400億元,供股價應該是46元),實際情況是12供5,每股約28港元,對於投資者來說,未必能分別出問題所在(因為4供1,每股46.66元,以一手400股計,供股一百股,供股金額4666元,而12供5的話,每手便是166股,集資金額也是4666元)。

對於匯控來說,是啞子吃黃蓮,因為兩者發行股數完全不一樣,4供1的話,匯控新發行股份是30億股,12供5的話,發行股份便是50億股,當中的差異是甚麼呢?如果匯控有能力的話,根本不可能接受這個條款。簽訂城下盟約,而今次包銷商是看淡匯控的高盛,如果早前高盛看淡匯控而身體力行,目前又能以極低價供股作包銷商,究竟反映甚麼大家心知肚明------匯控已經處於沒有選擇餘地,任由這些大戶宰割。

你看嘛,個股如果炒短線,實在太多變數要考慮了,實在難炒。我還是回去研究 Macroeconomics,炒 Commodities 和 Index ETF 算了!最近工作太忙,停了看 Forex。要找時間回去重新開一個 FXCM Microlot 玩模擬了。

香港個股投資,都最好看看內幕交易先,因為無乜可能我們外圍散戶比內部高層更清楚自己業務的具體情況到底是向好還是向壞走。

Monday, March 02, 2009

匯豐銀行底背離脫離突破下降軌道

0005.hk 剛剛做了底背離,看多。加上上周四五突破了下降軌道,給多了一個看多的理由。雖然上周是道指創新低的一周,但是,因為再創新低的時候,NYSE 同時創新低的股票數目已經不及去年11月和前一周數目多,所以,我們有理由相信本周美市都有技術性反彈,有機會帶動港股做好。

另一方面,看看 insider trades, 就好似無動靜,始終無明顯內部抄底現象出現。

Mr Buffett tends to write allegorically when in defensive mode

Mr Buffett tends to write allegorically when in defensive mode. The allegorical phrases are in red. Interesting read.

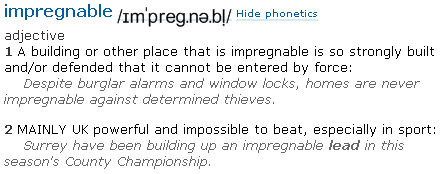

Buffett admits Berkshire battered but stays bullish -- In typical fashion, Mr Buffett told investors that 2008 "was devastating ... for corporate and municipal bonds, real estate and commodities. By year end, investors of all stripes were bloodied and confused, much as if they were small birds that had strayed into a badminton game". Mr Buffett also warned that the greater reliance on government aid was likely to lead to unwelcome and lasting consequences for the wider economy: "In poker terms, the [US] Treasury and the Fed have gone 'all in'. Economic medicine that was previously meted out by the cupful has recently been dispensed by the barrel. These once-unthinkable dosages will almost certainly bring on unwelcome after-effects. Their precise nature is anyone's guess, though one likely consequence is an onslaught of inflation."Gibraltar 定义是 An invincible fortress or stronghold; an impregnable stronghold.

While conceding there was little reason to expect a quick improvement in the global economy, Mr Buffett stressed Berkshire Hathaway would remain "Gibraltar-like" in its financial strength and invited investors to consider that its insurance arm, Berkshire Hathaway's biggest business along with the group utilities investment division, "delivered outstanding results in 2008" and has "excellent prospects".

at

3/02/2009 02:12:00 PM

0

comments

![]()

Labels: English words

你那儿够长吗?

男人又多一样东西担心够不够长了. 无名指比食指长出愈多, 证明产前雄激素旺盛, 影响将来一个男人长大了之后的睾丸素的 "排量"; 排量越多, 越喜欢承担风险, 视觉眼肌运动和其他身体肌肉的反应速度都会越快.

科学家做了调查, 发现在超短线职业外汇股票期货炒卖中, 无名指比食指长出愈多的交易员, 赚越多钱.

Neuroeconomics - Digitally enhanced - Successful financial traders are born as well as made

Testosterone and traders - Goldfingers - How traders' testosterone levels affect their income

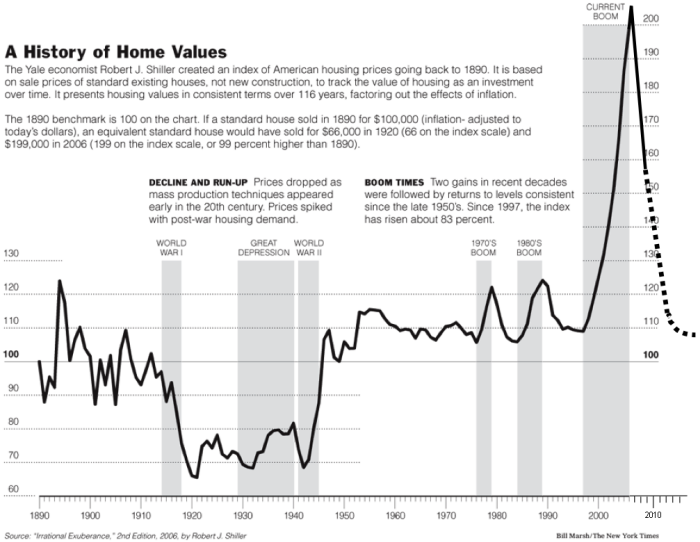

Glenn Beck 讥讽 Obama 无能力 "arrest" 房市跌势

Fox News commentator Glenn Beck makes a pretty straightforward case about the folly of trying to "stabilize" home prices at current levels in the following YouTube video segment from his show, "Glenn Beck":

推荐纪录片 Zeitgeist Movie

如果你今年只有心情看一部较为严肃的纪录片, 看 Zeitgeist Movie, 官网内有BT 种子下载. 有两个片, 第一部在 Shooter.cn 有中文字幕下载, 而续集则未找到有中文字幕。

If you can only watch one documentary series in 2009, watch the following.

Highly recommend a two-part documentaries: http://www.zeitgeistmovie.com/

The film maker makes the movie free. If you want, you may download from their official torrents.

两部片中, 宗教政治部分, 可看可不看, 但是, 经济部分却和我们生长的大环境息息相关, 严重推荐观看!

at

3/02/2009 04:11:00 AM

0

comments

![]()

Labels: bt, economics, finance, movie, recommendation

Thursday, February 26, 2009

自我催眠密码

NLP 或成功学导师教学员默想和对自己讲一些自我肯定或激励的话去培养自信。这种技巧,在很多行为心理学实验里面是被证实是奏效的。但是,我们有什么方法持之以恒呢?

我这里分享一个我从朋友那里学的小技巧。

我们在互联网中生活一代人,天天都要输入众多的登入信息和密码。

创制的密码,一般来说,都是越复杂越好。但是,复杂的密码,一般都非常难去记忆。如何去记忆着一个既复杂又容易记的密码呢?

这里举例说明。

先 想一个激励人心培养自信的句子,不妨狂妄自大一些。我来一句:『林川是宇宙最强。』其拼音就是 Lin Chuan Shi Yu Zhou Zui Qiang. 然后,抽出拼音中的头一个单词,化成 lcsyzzq。完成!lcsyzzq 成了我的复杂而又难以被猜到的新密码了!

试想一下,我们天天都要在不同的地方输入登入信息和密码,我们为了记忆密码,必须默想催眠『咒语』来回忆密码,这么一来,就一箭双雕,密码能回忆起来,更也能自我催眠了!

Wednesday, February 25, 2009

长『揸』股票足以致贫

有无人告诉过你,股市长线持有,是致富的必然途径?

别被蒙骗!

美国很多财经媒体都宣称美国股市回报率,自从 1900 年起,每年平均有 6% 的回报。然而,据 London Business School and Credit Suisse Group AG 综合了通胀之后的数据显示,撇除 dividends 和 annual gain 之后,年均升幅只剩下 1.7%. 如果你是美国人,买国债都起码有 2.1% 的稳妥回报率。如果在中国,就更不要说了,长期以来,中国内地银行的定期存款是傲视同群,世界各地银行都无法匹敌的!

几个月前,一个理财异常保守的广州亲戚提醒我,我才发现国内银行定期存款的金矿;赶紧砸了为女儿读书准备的,和老婆勾手指『不许动』存款存进去五年定期,稳稳当当在5年后收超过百分之二十五的利息回报!

Monday, February 23, 2009

Friday, February 20, 2009

Monday, February 16, 2009

保证金借贷投资水平下降证实投机者在陆续退场

风险胃口越减越瘦到 2008 年底的 186.71 Billion USD。密切注视2009年开年第一个月的保证金借贷水平!

at

2/16/2009 05:08:00 AM

0

comments

![]()

Labels: data, fundamental, stocks

道指尝试探11月份的底

道指和NYSE的过去30年的历史数据指出,当道指做了52周新低的时候,如果NYSE有少于400个股票创52周新低,则道指会造成一个 V 型底部,然而,如果NYSE有多过400个股票创52周新低,则道指会造成一个 W 型底部 (1990 年是例外,创了不止1个W的底部,探底了不止两次)

道指在10月10日创了新低,当时 NYSE 有 2901 个股票创新低,是刷新了同时创新低的记录!

道指在11月20日再创新低的时候,NYSE则有1894个新低,也算很多了!

周五收市时候离20日当时价位3.9%,如果再次探底的时候无太多 NYSE 的新低创出,这次将会是一个中期的底部。

Tuesday, February 03, 2009

台湾烹饪节目爆笑 (真人真事)

今天偶然扭开看到了某台湾非常正式的烹调节目 (肯定不是 "乜太"). 两个女主持人(非常严肃地) 教弄微波炉鸡蛋.

甲负责烹调, 在打鸡蛋; 乙旁边学习和评述.

乙: 我就知道你喜欢这样.

甲: 喜欢怎样?

乙: 喜欢打蛋.

我笑傻了一会儿. 平复之后, 紧接又听到甲乙继续说.......

甲: 我装碗吧.

乙: 我比较传统, 喜欢这样硬硬的.

甲: (尴尬) 啊?

乙: 我说你用这个碗看起来硬硬的.

甲用的那种日式方形碗, 乙女士竟然用 "硬硬的" 去形容.

Saturday, January 31, 2009

你那儿够长吗?

男人又多一样东西担心够不够长了. 无名指比食指长出愈多, 证明产前雄激素旺盛, 影响将来一个男人长大了之后的睾丸素的 "排量"; 排量越多, 越喜欢承担风险, 视觉眼肌运动和其他身体肌肉的反应速度都会越快.

科学家做了调查, 发现在超短线职业外汇股票期货炒卖中, 无名指比食指长出愈多的交易员, 赚越多钱.

Neuroeconomics - Digitally enhanced - Successful financial traders are born as well as made

Testosterone and traders - Goldfingers - How traders' testosterone levels affect their income

Sunday, January 04, 2009

灰尘勿扰

我和太太去看了灰尘勿扰 (湖南话发音讲"非诚勿扰") . 讲舒淇和做有妇之夫的方中信搞婚外情. 舒淇算是剧中的主角吧.

做别人第三 者的女人, 我倒是认识过几个. 不知道是不是我运气特别好, 老是结识到那些做过别人第三者或甚至正在做别人第三者的女人. 当我认识到第四个的时候, 我已经按奈不住我的情绪了, 我劈头就骂了过去, 告诉她是我之前认识那些做别人第三者的女人的翻版. 他们的心理状态全部都是一个实验室样本复制 Clone 出来的.

我当时恨不得一巴掌打过去. 希望骂她实在太傻了. 可惜只是通过电话中听到倾诉, 那巴掌打不过去.

记得我第一次听做人第三者的女人的倾诉, 倒是挺新鲜的; 第二次, 感到了同情; 遇到了第三个的时候, 已经麻木了. 只是感觉很叹息, 想帮她一把, 拉她一下, 但是爱莫能助.

我 太太问我, 会不会做方中信, 外面搞个情人来玩. 我告诉她, 我做方中信的时候, 大概也是灰尘勿扰电影中的方中信, 出入飞机都坐头等舱的时候了, 到时候, 妳也应该富足, 满心欢喜. 我外面搞个空姐舒淇, 也是完全背着妳. 在妳毫不知情的情况下, 我又尽足了做老公的本分, 大概无什么问题了吧, 是吗? 顶多都是我这个方中信为了感情挣扎而辛苦, 而完全不影响妳呢! 哇哈哈哈!

算了吧.

还是不要背着女人干坏事. 要干, 就要摆明的. 讲明自己博爱, 也有条件博爱, 要去纳妾就好了. 旧社会好, 合理: 当财富和资源集中在某一些人群中的时候, 优生优养, 就是要多房, 多太, 纳妾, 多娶, 天公地道!

现 代略有身份地位的富裕的男人都很无奈, 因为他们都无法享受得到旧社会甚至是古文明的人力资源分配道德观. 现代男女关系和世界上的资源分配一样地不合理! 大部分的人都在挨饿, 少数人能富裕和吃饱饭. 可恨的就是资源并非不足, 而只是分配不恰当! 在这种情况下, 当下弱势群体只是要求成为富裕男人的二房妾士都成为违法违章遭人冷眼, 灰尘勿扰的故事, 就真是满街都是. 感觉就是像资源分配不恰当的地球村一样, 烽火战争连绵不绝, 壤成无谓的斗争, 无谓的牺牲.

现代人类几时才醒觉, 懂得恢复我们多个原始和旧社会都认同的先祖智慧, 再次把一夫(妻)多妻(夫) 重新编订入道德和法典的正轨呢?